oregon workers benefit fund tax rate

Workers compensation indemnity benefits are cash benefits paid to injured workers. These benefits include benefits for temporary disability.

Oregon Workers Compensation Assessment Rate Unchanged For 2022

Enter a Tax ID.

. Employers are required to pay at least 11 cents per hour. The WBF is funded by cents-per-hour assessments on both employers and employees. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years.

Employers and employees split this assessment which employers collect through payroll. Enter a Tax ID. For 2022 the rate is 22 cents per hour.

Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. What is the 2022 tax rate.

For 2022 our analysts recommend no change in the current assessment which means. Enter a Tax ID. Oregon Workers Benefit Fund assessment unchanged for 2022.

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. This tax rate is the same for all employers and is normally calculated automatically in.

The Workers Benefit Fund is one of two funds to which monies from the assessments are deposited. OregongovdcbscostPagesindexaspx for current rate notice. Oregon has several benefit programs that are paid from the Workers Benefit Fund.

The 2022 payroll tax schedule is a. Enter the tax formula and table rate information. When you apply for unemployment insurance benefits you can choose to have 10 of your weekly benefit amount withheld for federal income taxes andor 6 for state income.

Oregon workers are subject to Workers Benefit Fund WBF assessment tax. Self-insured employers and public-sector self-insured employer groups pay 99 percent. This assessment is calculated based on employees per hour worked.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled. The attached pdf provides definitions of the data. Enter the tax formula and table rate information.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund. Remains at 98 percent in 2023.

The workers benefit fund assessment rate will be 22 cents per hour in 2023. For example The 2017-2018 rate is 28 cents for each hour or partial hour and. The purpose of the tax is to help fund programs in Oregon to help injured workers and their families.

Private-sector self-insured employer groups pay 103 percent. Departments through quarterly payroll tax reports and the revenue is transferred to DCBS. Go online at httpswww.

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to. The other fund is the Consumer and Business Services Fund. The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

Enter the tax formula and table rate information.

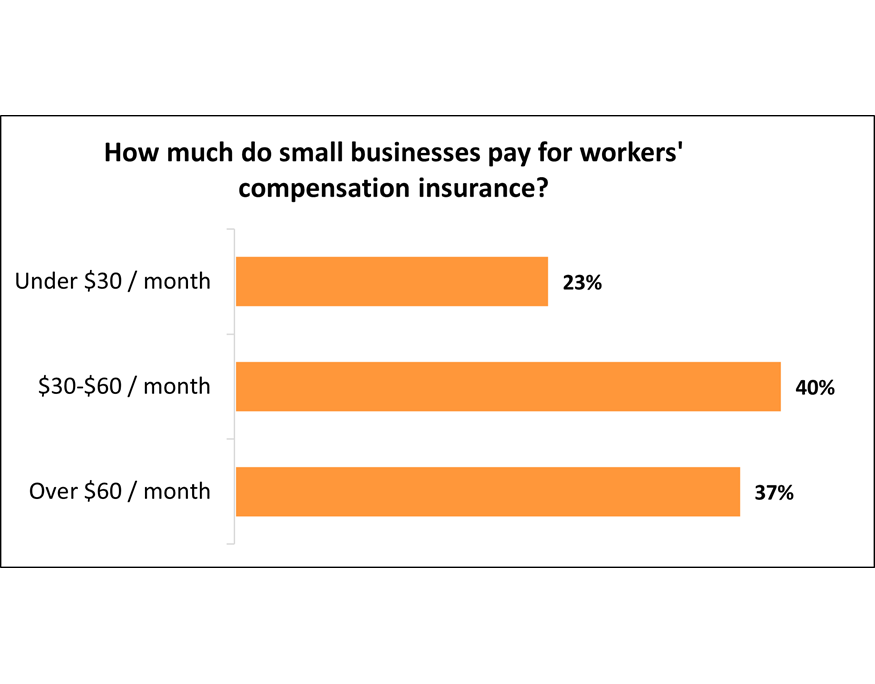

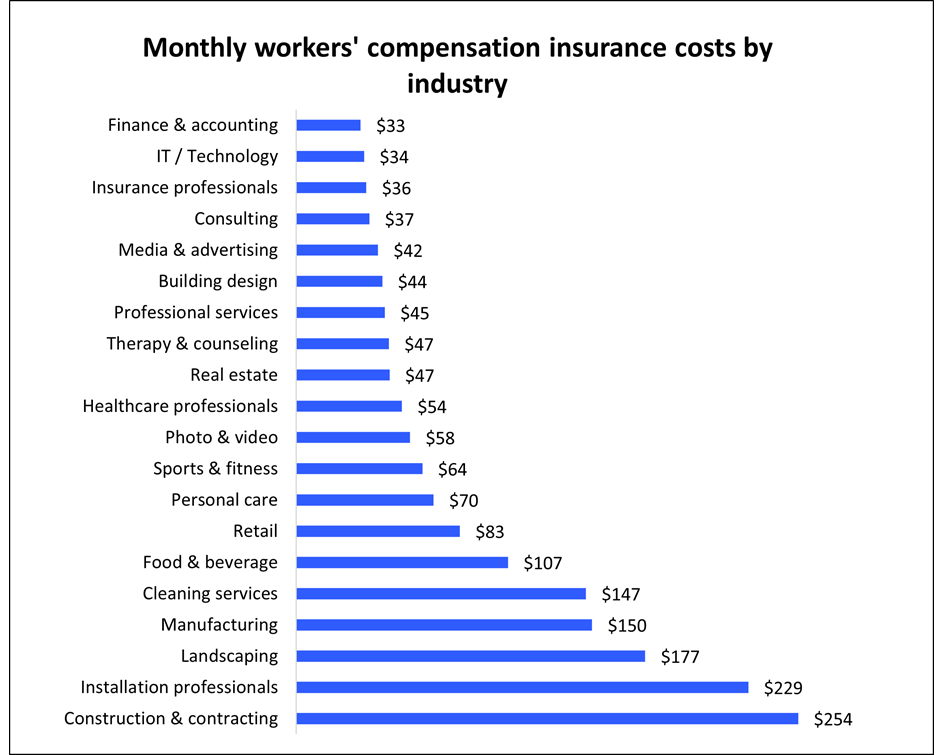

Workers Compensation Insurance Cost Insureon

Calculate Workers Comp Insurance Cost Embroker

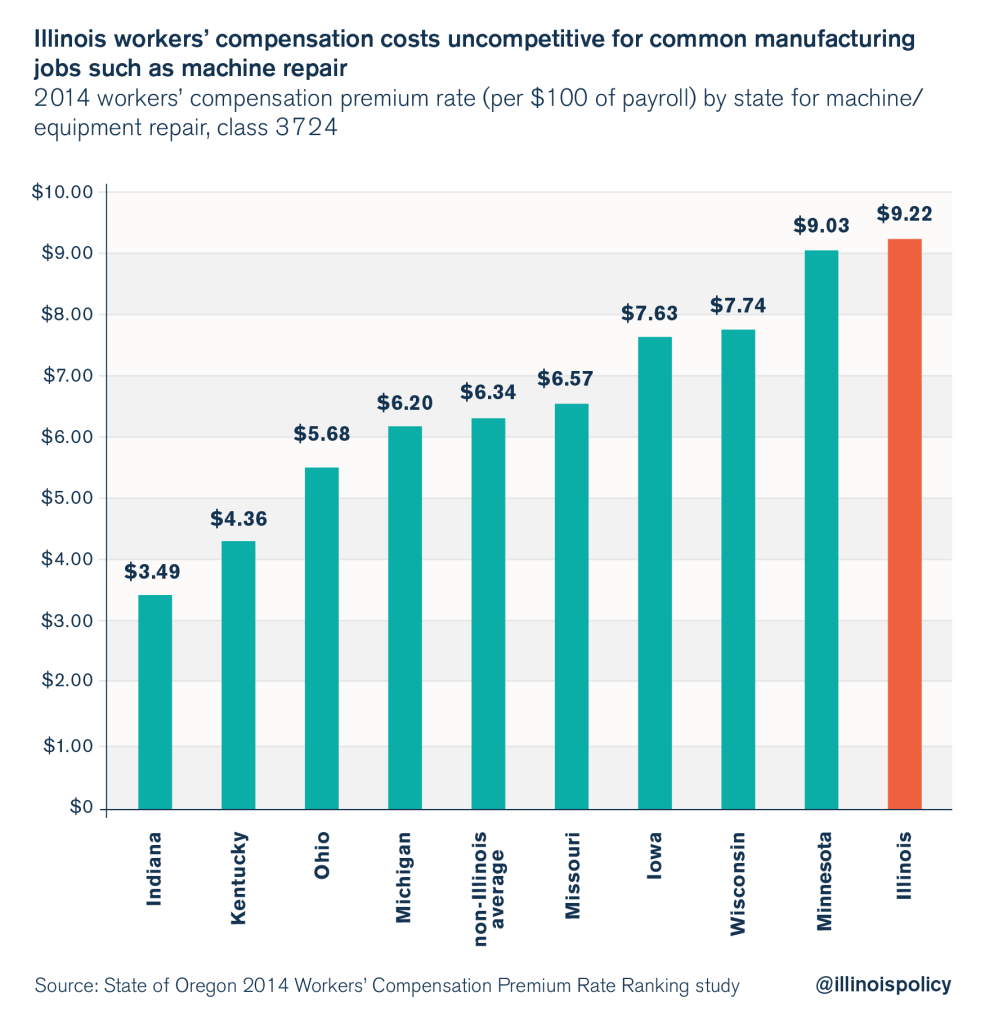

Illinois Remains Most Expensive State In Midwest For Workers Compensation Illinois Policy

Workers Compensation Laws By State Embroker

Workers Compensation Insurance Cost Insureon

Benefit Adequacy In State Workers Compensation Programs

Oregon Workers Benefit Fund Payroll Tax

Park Development Partners Industrial Relocation Nw Indiana

2022 Federal State Payroll Tax Rates For Employers

How Are Workers Compensation Benefits Calculated Foa Law

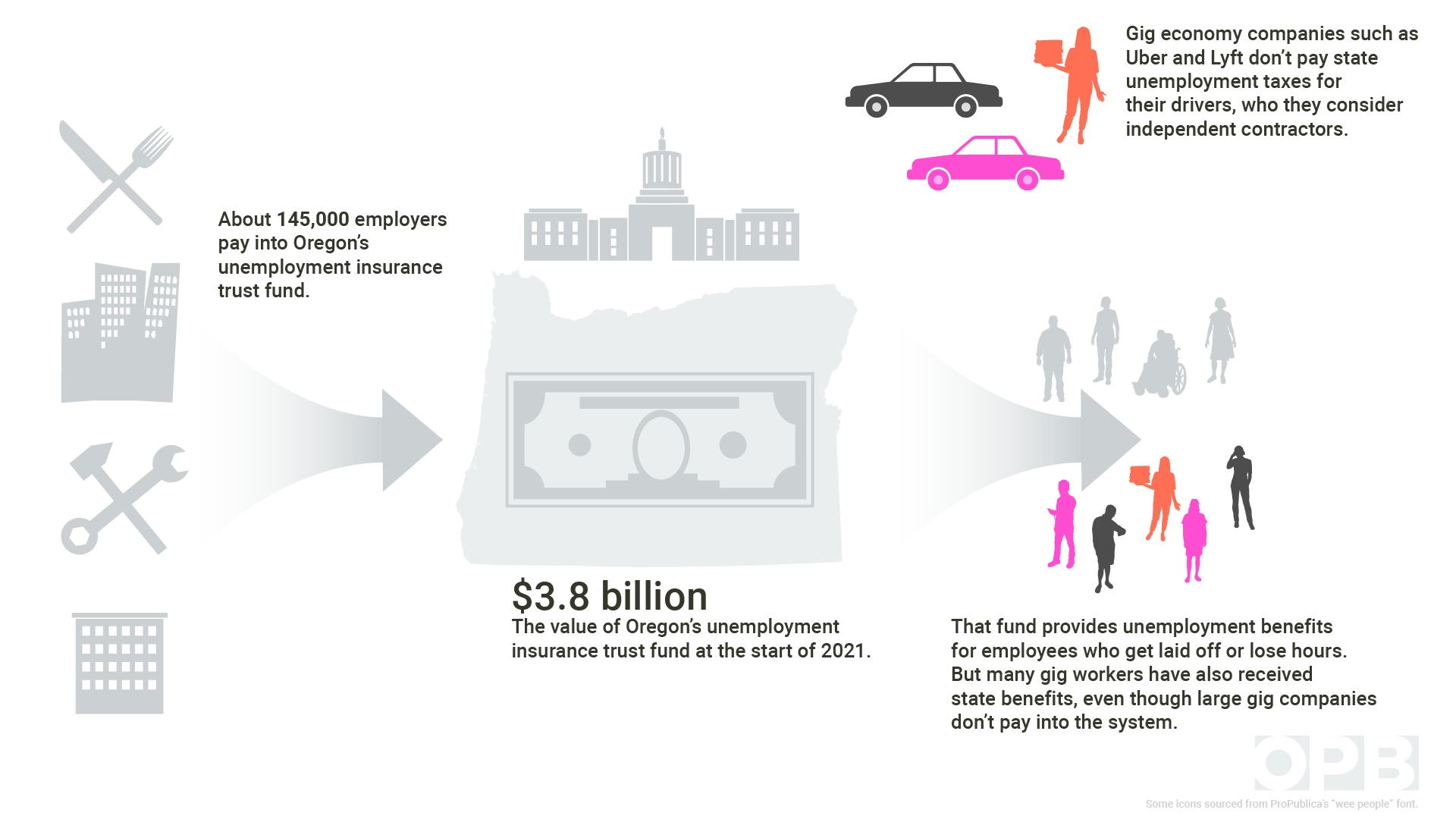

Many Oregon Gig Workers Got Regular Unemployment Benefits Here S Why It Matters Opb

Workers Compensation Rates Explained 2020 Workers Comp Rates

2021 Maximum Minimum Time Loss Rates In Wa Labor Industries Claims

Department Of Consumer And Business Services Oregon Workers Compensation Costs Oregon Workers Compensation Costs State Of Oregon

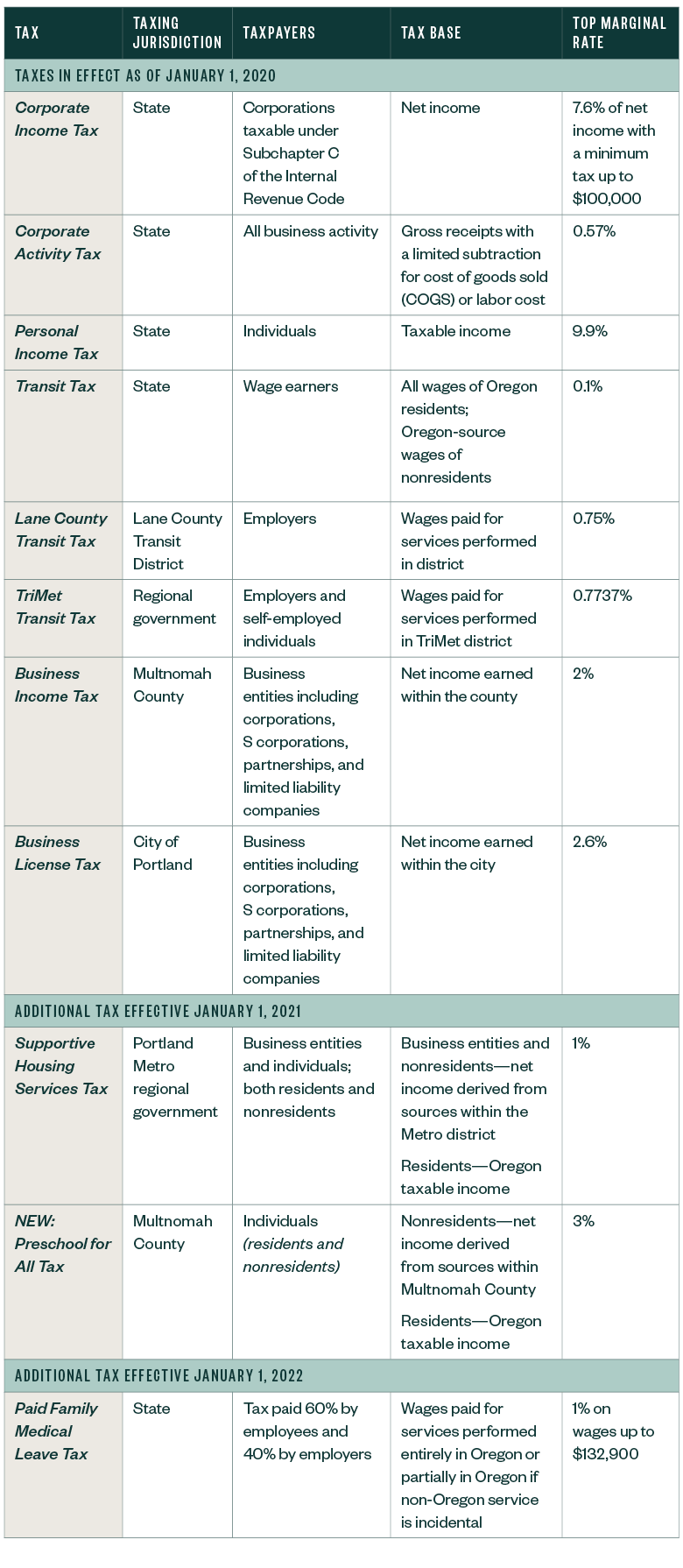

New Portland Tax Further Complicates Tax Landscape

Workers Compensation Laws By State Embroker

Department Of Consumer And Business Services Oregon Workers Compensation Costs Oregon Workers Compensation Costs State Of Oregon

Free New Mexico Workers Compensation Act Labor Law Poster 2022